Covid-19 has particularly impacted mobility due to a fall in transport activities. If this fall is to continue is uncertain and what the implications on policy are. However, post-COVID recovery offers a critical policy window for managing adverse effects on energy demand. Strengthening and countering policies for impacts from COVID-19 are discussed and what impact this has on mobility and homes.

Authors: Charlie Wilson and Bas van Ruijven

Key research insights

The IEA recently published energy demand data for transport, buildings and industrial sectors in 2020 with an analysis of COVID-19 impacts (IEA, 2020a). These impacts have been profound particularly in transport. Compared to 2019, overall activity has fallen sharply in aviation (down 60% in 2020) and public transport incl. rail (down 30%). Remaining air, rail and bus services have lower load factors so their energy intensity per passenger transported has increased. Public and shared modes have been substituted by private vehicle use and active modes, particularly in cities (ITF, 2020; IEA, 2020b). New car sales are down 10%, slowing the transition to electric vehicles. Impacts on energy demand in buildings and industry are also clearly evident although less extreme. Energy-intensive industrial output like basic metals (down 15%) has been less affected than higher value-added manufacturing like automotive manufacturing (down 30%). In buildings, overall activity has shifted from offices and retail to homes. In the first half of 2020, residential electricity use increased by around 20-30%, only partially offset by 10% reductions in office buildings for which essential services like heating and ventilation are energy-intensive (IEA, 2020a). Smart gas meter data shows an increase in home heating activity throughout the day given higher occupancy levels (Octopus Energy, 2020). Two positive impacts are the increase in do-it-yourself home renovations incl. sales of insulation products, and increases in online purchases of new appliances (up 20-40%) at least some of which should replace older, inefficient models (IEA, 2020a).

Policy implications

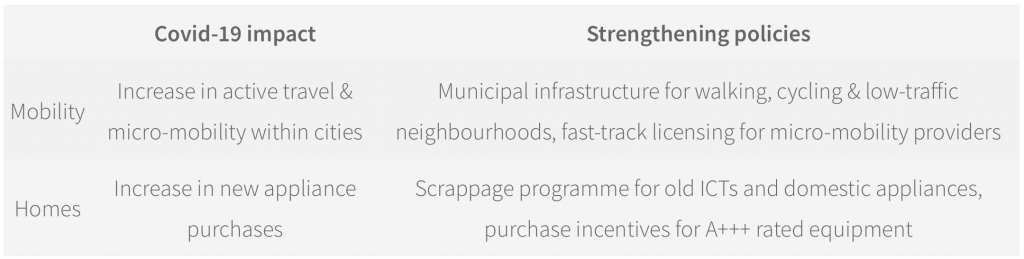

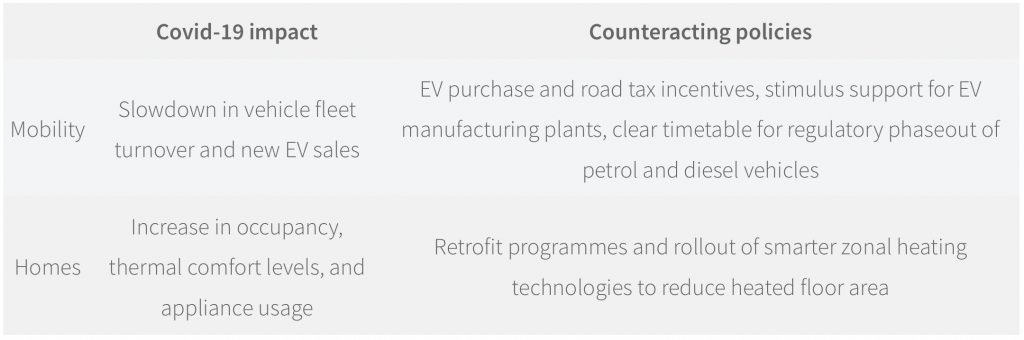

Whether these impacts of COVID-19 on energy demand will persist is highly uncertain. But as the IEA concludes: “… in the absence of targeted government policies, a return to pre-pandemic behaviours is likely” (IEA, 2020a). This has two important implications. First, the persistence of COVID-19 impacts should be monitored and tracked over the next 12-18 months to enable robust long-term analysis and modelling of net-zero pathways and required policy responses. Just as some 2020 impacts may prove transient, other slower-to-emerge impacts may prove important - for example a shift in consumer investments from efficiency to digital, health and comfort technologies (Boumphrey, 2020). Second, and more immediately, the post-COVID recovery opens up a critical policy window for managing adverse effects on energy demand while strengthening and embedding beneficial effects (see tables for examples for transport and residential sectors).

Related reports/information

References:

Boumphrey, S. (2020) How will consumer markets evolve after coronavirus? Euromonitor International.

IEA (2020a) Energy Efficiency 2020. International Energy Agency.

EA (2020b) Changes in transport behaviour during the COVID-19 crisis. International Energy Agency.

ITF (2020) Re-spacing our cities for resilience. International Transport Forum.

Octopus Energy (2020) Energy consumption under social distancing measures.

This report is available here.

NAVIGATE

Project details

- Project title: Next generation of advanced integrated assessment modelling to support climate policy making

- Funding scheme: European Union Horizon 2020 Programme (EU H2020, Grant agreement ID: 821124)

- Duration: 4 years (1 September 2019 – 31 August 2023)

- Project coordinator: Potsdam Institute for Climate Impact Research (PIK)

- Project website: https://navigate-h2020.eu/